Sacramento, CA – Local school districts would have more flexibility in managing their own money during economic downturns under legislation approved on Monday by the Senate.

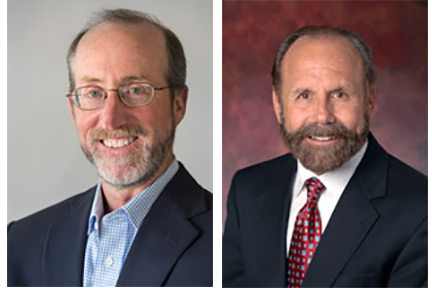

Senate Bill 751, approved on a 38-0 vote, was co-authored by Sen. Steve Glazer, D-Orinda, and Sen. Jerry Hill, D-San Mateo. It would lift the local school district reserve cap from 6 percent to 17 percent, a nationally recognized standard for local government agency reserves. The bill now moves to the Assembly.

“I’d prefer to eliminate all caps to provide local school districts with decision-making authority that is rightfully theirs,” Glazer said. “But, we can at least take some solace that we are moving toward restoring fiscal responsibility to the budgeting decisions of local school districts.”

SB 751, beginning in 2018-2019, also exempts small school districts (with fewer than 2,501 students) and districts that don’t receive state aid. Small districts can be hit especially hard with sudden expenses at any moment such as increased special education costs or loss of enrollment.

The bill was a response to a budget trailer bill approved in June, 2014 as part of the state budget which included a provision that has come to be known as the school district reserve cap. It is a requirement that limits school districts’ rainy day reserves and their ability to respond to fiscal crises. The reserve cap requirement is triggered once the state makes a deposit into the Public School System Stabilization Account, which only occurs when certain conditions are met.

With budget projections looking uncertain in the coming years, the trigger for the cap may be activated in coming budget cycles. This could cause districts to spend their rainy day funds, creating turmoil for school districts, bond rating agencies, school boards and school administrators.

“School districts need to have the ability to protect employees and programs during the next recession and the flexibility to set funds aside for large purchases like text books, new technology and school buses,” Glazer said, “while also funding school construction, self-insurance, and large maintenance projects.”

The current state reserve cap imposes a unique hardship for small and basic aid districts. The cap affects small and basic aid districts in different ways. Small districts, by definition, have low average daily attendance (ADA), which means they also have small budgets. Applying a 6% cap to these districts would result in inadequate reserves.

The concern with basic aid districts is that they do not receive state funding. Presumably, the state would use the Local Control Funding Formula (LCFF) to distribute funds from the Public School System Stabilization Account (PSSSA) to local school districts when conditions warrant. Since basic aid districts do not receive LCFF funding, they would not benefit from this distribution mechanism. Additionally, they only receive funding from their counties twice a year and must keep additional monies in reserve for cash flow purposes.

SB 751 fixes both of these problems by exempting small and basic aid districts from the cap.